Market Commentary and Outlook – May 2025

Global Market Performance

May 2025 delivered a robust rebound for U.S. equities, with the Nasdaq soaring 9.7%—its strongest monthly gain since late 2023—driven by a resurgence in semiconductor and industrial stocks. The S&P 500 and Dow Jones also posted solid gains of 6.3% and 4.2%, respectively, marking a broad-based rally across major indices. Global markets also had a solid month; Developed Markets posted a 4.7% gain and Emerging Markets added 4.3%.

In the US, the technology sector led the charge, climbing 10%, with notable contributions from companies like Microchip Technology, Broadcom, and First Solar, each posting gains exceeding 25%. Industrials and Consumer Discretionary sectors followed closely, rising 8.8% and 8.4%, respectively. Conversely, the Health Care sector lagged, declining 5.6%, making it the sole sector in the red for the month.

Despite the equity market’s strength, consumer sentiment painted a contrasting picture. The U.S. Index of Consumer Sentiment fell to 52.2 in May, its third-lowest reading on record, indicating that consumers remain cautious amid ongoing economic uncertainties.

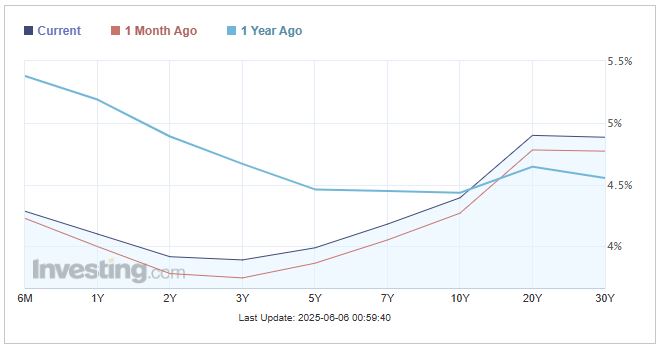

In fixed income, longer-term Treasury yields rose, steepening the yield curve. Yields on Treasury instruments between 1 and 30 years increased by 24 to 29 basis points, while shorter-term yields saw minimal changes. This shift led to a 3.2% decline in long-duration bond funds, such as the iShares 20+ Year Treasury Bond ETF.

The U.S. inflation rate cooled off to 2.31% in April, while core inflation held steady month-over-month at 2.78%. After dipping slightly in March—the first drop since May 2020—the Consumer Price Index ticked up modestly by 0.2%. Meanwhile, personal spending edged up 0.23%, signaling steady consumer activity.

At its May 7th meeting, the Federal Reserve kept its key Fed Funds Rate unchanged at 4.25%-4.50%, marking the third consecutive pause. Looking ahead to the June 18th meeting, markets expect rates to remain steady, as indicated by the CME FedWatch tool.

Gold prices remained relatively flat in May, breaking a four-month winning streak, with GLD closing the month at $303.60 per share. Meanwhile, cryptocurrencies experienced significant gains; Bitcoin surged 10.4% to a new all-time high of $104,010.90, and Ethereum jumped 40.5% to $2,524.48.

According to FactSet, Q1 2025 delivered exceptionally strong corporate performance amid challenging economic conditions. The Mag 7 companies reported actual Q1 2025 earning growth of 27.7%. The overall S&P500 blended year-over-year earnings growth rate reached 12.9%, marking the second consecutive quarter of double-digit earnings growth and the seventh consecutive quarter of year-over-year earnings growth. This robust performance occurred before Trump announced his comprehensive tariff policy on April 2.

Market Outlook

Currently, the S&P 500’s forward P/E ratio stood at 21.1, above both the 5-year average (19.9) and 10-year average (18.4), reflecting investor confidence in continued earnings momentum. Companies demonstrated pricing power and operational flexibility, with 251 companies providing positive 2025 guidance versus only 8 withdrawals, showcasing corporate management’s confidence in navigating current challenges while maintaining growth trajectories.

With the stock market index rebounding close to all-time high, we feel that greed has returned to the market. Therefore, we have turned more cautious in the short term as we believe that geopolitical tensions and policy uncertainties remain and could trigger a market correction at any time. However, we remain very bullish on the US market for the long term as the secular trends driving these US-listed global conglomerates remain intact.