Monthly Market Wrap: August 2025

August saw steady gains across the board, with small caps leading the charge and healthcare making a remarkable comeback as the top-performing sector. Meanwhile, labor market signals softened, home prices took a rare dip, and the Fed dropped some hints about potential rate cuts coming in September. On the crypto front, Ethereum kept the momentum alive, hitting fresh all-time highs.

August at a Glance: Small Caps Shine, Labor Market Softens, Yields Edge Lower

Markets pushed higher across the board in August. The Russell 2000 stole the spotlight with a strong 7.14% gain, while international developed equities climbed 4.27%, reflecting broad investor optimism despite ongoing economic uncertainties.

Sector-wise, healthcare led the pack with a 5.4% rebound, closely followed by materials. Technology and utilities were the only laggards, with industrials flat for the month.

The labor market showed signs of cooling: the unemployment rate ticked up to 4.2%, labor force participation fell for the fourth consecutive month, and job growth slowed to just 73,000 in July, missing expectations again. Housing markets reflected this caution, with existing home prices dropping 2.38% their first decline since January. The Fed kept rates steady but adopted a more dovish tone at Jackson Hole, fueling speculation about September rate cuts.

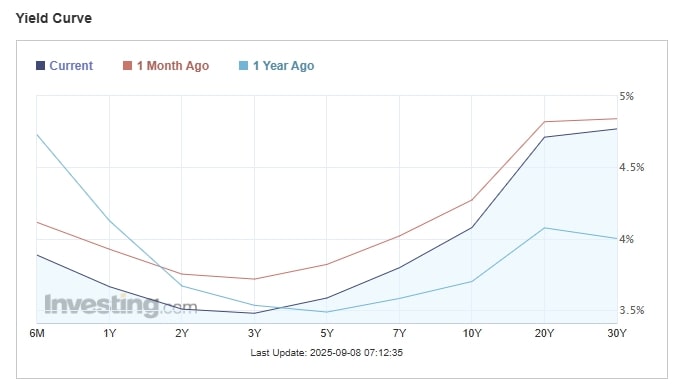

Fixed Income & Treasury Yields

Yields slid lower along the curve except for the 30-year, which ticked up slightly. The 2-year Treasury yield took the biggest drop, falling 35 basis points to 3.59% as the market increasingly prices in Fed easing.

August marked a pivot toward expected rate cuts after months of uncertainty. Fed Chair Powell’s comments at Jackson Hole signaled that with policy already restrictive, a shift to easing could be near. Markets are pricing in more than a 90% chance of a cut in September, a major shift from the uncertainty back in spring.

For investors, this means it’s a good time to review portfolio positioning balancing growth opportunities with a watchful eye on how a changing rate environment could impact sectors and fixed income.

Economic Snapshot

- Jobs: 73,000 new jobs added in July, below estimates

- Unemployment: Rose slightly to 4.2%

- Home Prices: Median existing home price fell 2.38% to $422,400

- Inflation: Core CPI steady around 3.06%

- Fed: Rates on hold but markets expect cuts soon

Crypto and Commodities

Ethereum surged 15% hitting new highs near $4,829 before a slight pullback, while Bitcoin slipped about 8%. On the commodity side, oil prices fell roughly 7%, gold was relatively flat but saw gains into early August.

Market Outlook

September has lived up to its reputation as a tricky month for markets. Stocks are coming off all-time highs, but history tells us this is often a soft patch, with the S&P 500 typically pulling back in September. That said, the mood isn’t all bearish—many strategists see any weakness as a healthy breather rather than the start of a bigger downturn.

Expectations for a modest Fed rate cut later this month are keeping optimism alive, especially after softer job numbers in August. In short, it’s a market that rewards patience and selectivity: quality companies in tech, healthcare, and other growth sectors still look attractive if you’re willing to ride through short-term chop.

On the bond side, yields on long-dated debt around the world have surged, making income opportunities more appealing—but also raising risks for traditional stock-bond diversification. U.S. Treasuries have been more stable compared to their global peers, while corporate bond issuance has picked up, showing companies still have confidence in funding conditions.

The bottom line—keep portfolios balanced, stay nimble, and treat any dips as potential opportunities rather than panic signals.