Summer Surge: Equities Rally, IPOs Return (July 2025)

Global Market Performance

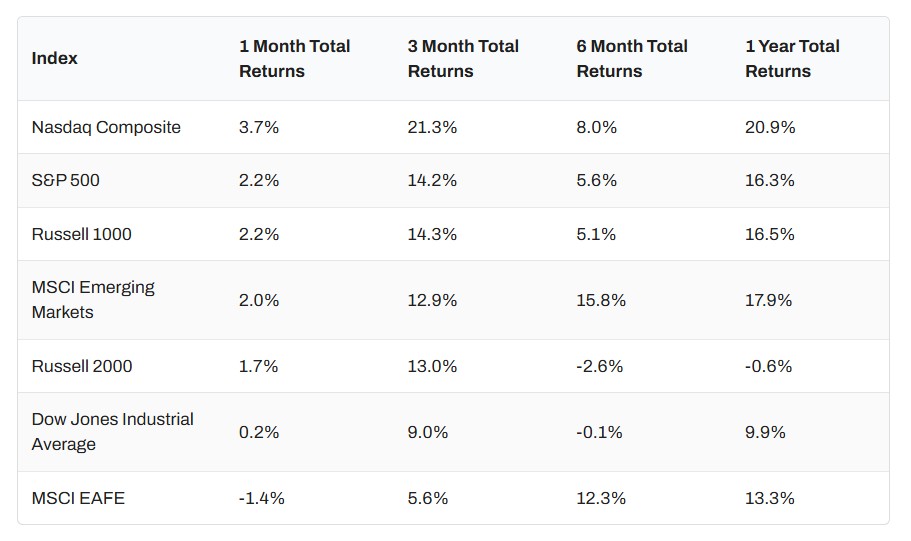

Equities got off to a solid start in the second half of 2025, with most major indexes finishing July in the green. The S&P 500 climbed 2.2%, the Nasdaq outperformed with a 3.7% gain, and even the Dow managed a modest 0.2% lift. The only outlier was international developed markets (EAFE), which slipped 1.4% for the month.

Interestingly, both ends of the economic spectrum led the charge—defensive Utilities rallied 4.9%, while growth-heavy Technology wasn’t far behind, up 3.8%. Industrials also had a strong showing, gaining 3%. On the flip side, Health Care took a hit—down 3.2%—with six of the S&P 500’s ten worst-performing names in July coming from that sector.

Fixed Income Update

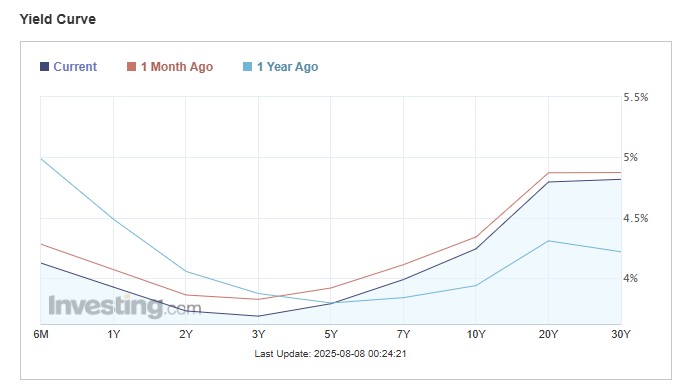

Treasury yields moved higher across the curve in July, except for the 3-month, which held steady at 4.41%. The 2-year yield saw the biggest jump, climbing 22 basis points for the month. As rates rose, bond prices took a hit. Long-duration funds like the iShares 20+ Year Treasury Bond ETF slipped 1.1%, reflecting the pressure from higher yields.

Macro Update

Inflation ticked up slightly in June, with headline CPI rising to 2.67% year-over-year and core inflation edging up to 2.93%. On a monthly basis, consumer prices increased 0.3%, while personal spending posted a modest 0.34% gain. At its July 30th meeting, the Federal Reserve held the Fed Funds Rate steady at 4.25%–4.50%—marking the fifth meeting in a row without a change.

Gold had an early rally in July, up as much as 3.7%, but gains faded by month-end with the commodity down 0.61% for the month. Cryptos kept their momentum going in July. Bitcoin climbed 8.7% for the month, finishing at $117,833 and pushing its year-to-date gain to a strong 27.2%.

Tech Stock Earnings Beat

This earnings season, all eyes were on the Magnificent Seven, with investors looking for both company-level guidance and broader market signals in their Q2 results. Six of the seven delivered, topping earnings expectations with solid upside surprises. Alphabet, Amazon, Apple, Meta, Microsoft, and NVIDIA all beat the Street on EPS, reinforcing their leadership status. The one miss? Tesla. It fell short by 1.1% on earnings, standing out as the lone laggard in an otherwise strong showing from the group.

IPO Market Returns

As we hit mid-2025, we are seeing the long‑awaited revival of tech IPOs. After the 2021 boom that fizzled by 2022 under rising rates and inflation, the public window had slammed shut. Now, with policy shifts and investor sentiment thawing, 2025 is poised to break the ice again. Lina Khan’s aggressive antitrust agenda at the FTC transformed Big Tech M&A dynamics, from blocking major acquisitions to creating exit uncertainty for startups. But with a transition to a more merger‑friendly administration after 2024, regulatory friction is loosening—and that’s re‑opening the IPO runway for many firms.

A few companies have already debuted big: CoreWeave (AI infrastructure) soared over 150% early on; Circle (stablecoin issuer) spiked 3–5 times; Chime delivered modest gains; and later‑stage firms like Figma, MNTN, Ambiq Micro, and Metsera also wowed day one trading with solid upside. And more are waiting in the wings—Cerebras, Databricks, Stripe, Klarna, StubHub, Hinge Health, and eToro–many may go public in the second half of 2025 if appetite stays strong.

2025’s IPO landscape is competitive. Companies need strong earnings discipline, clear differentiation, and investor‑ready structures to get traction. Busy sectors? AI, fintech, crypto, life sciences, digital health, and defense tech are all in IPO‑worthy shape. M&A also remains an active exit strategy for firms hesitating to list.

Market Outlook

As we head deeper into Q3, markets are riding solid momentum from July’s tech-led rally, but August could bring some seasonal chop. Historically, a quieter month for volume, it’s also when macro headlines tend to move markets more easily. With inflation creeping higher and Treasury yields rising, investors will be watching for clues in upcoming CPI and jobs data that could shift the Fed’s tone. Earnings season wraps up this month, and any guidance cuts could test equity valuations, especially in growth sectors. Still, with crypto gaining traction, IPOs revving back up, and the Fed maintaining its pause, there’s room for cautious optimism—if data cooperates.