The 10–15 Years Before Retirement Are Where Outcomes Are Locked In (Part II)

Why Pre-Retirement Portfolio Structure Matters More Than Most People Realize

If you’re in your 50s, you might feel like retirement is still a few years away, just another phase of saving and investing. But here’s the thing: the choices you make in this decade quietly shape whether your retirement feels secure, or stressful.

The Pre-Retirement Blind Spot You Might Not See

Most investors in their 50s are:

- Still invested like growth-focused investors

- Still benchmarking performance against the market

- Still assuming they’ll “de-risk later”

What’s often missing is the recognition that risk capacity is already declining, even if risk tolerance hasn’t caught up. This gap between mindset and reality is where costly mistakes happen.

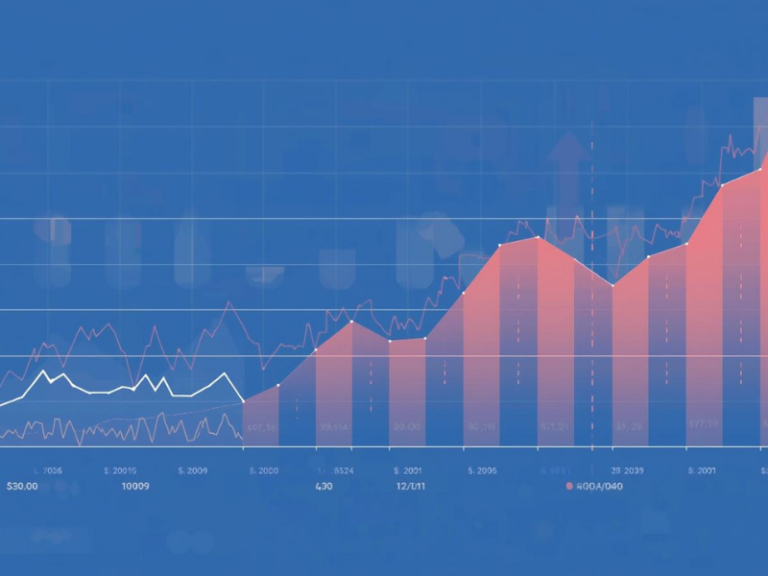

Sequence Risk Starts Earlier Than Most Think

Sequence-of-returns risk is usually described as a problem for retirement, something that hits once withdrawals begin.

In reality, it often starts earlier. A major market decline at age 55 or 58 can:

- Permanently reduce future income potential

- Force portfolio changes at unfavorable times

- Delay retirement or increase reliance on continued work

- Create stress that drives reactive decisions

At this stage, timing matters more than average returns.

Why “I’ll Just Ride It Out” Becomes Risky

Earlier in life, volatility is often tolerable because:

- Contributions are ongoing

- Income is rising

- Time smooths outcomes

In your 50s:

- Earnings peak but become less predictable

- Career options narrow

- Emotional cost of losses rises

Even well-diversified portfolios tend to become more correlated during market stress. When everything declines together, long-term strategies are often tested at the worst possible moment.

The Portfolio Shift Most People Delay

Successful pre-retirement planning doesn’t abandon growth, it re-prioritizes.

Key shifts include:

- From maximizing returns → stabilizing outcomes

- From pure market exposure → multiple return drivers

- From paper wealth → future cash-flow readiness

This isn’t market timing. It’s structural preparation. The goal is optionality, the ability to adapt regardless of market conditions.

What a Strong Pre-Retirement Portfolio Emphasizes

Instead of fixed allocation rules, effective transition portfolios share these traits:

- Reduced sensitivity to major drawdowns

- Intentional liquidity planning

- Clear segmentation between growth and future income

- Flexibility if markets are volatile or flat for extended periods

The portfolio is no longer judged solely by returns, but by how well it supports future decisions.

The Question That Matters Most

Before making, or avoiding, any changes, ask yourself:

“If the market takes a hit over the next 10 years, will my plan still hold up?”

If your answer depends on everything going perfectly, the problem isn’t being pessimistic, it’s how your portfolio is structured.

This realization naturally leads to the next question: How does this portfolio actually turn into income?