October Market Wrap

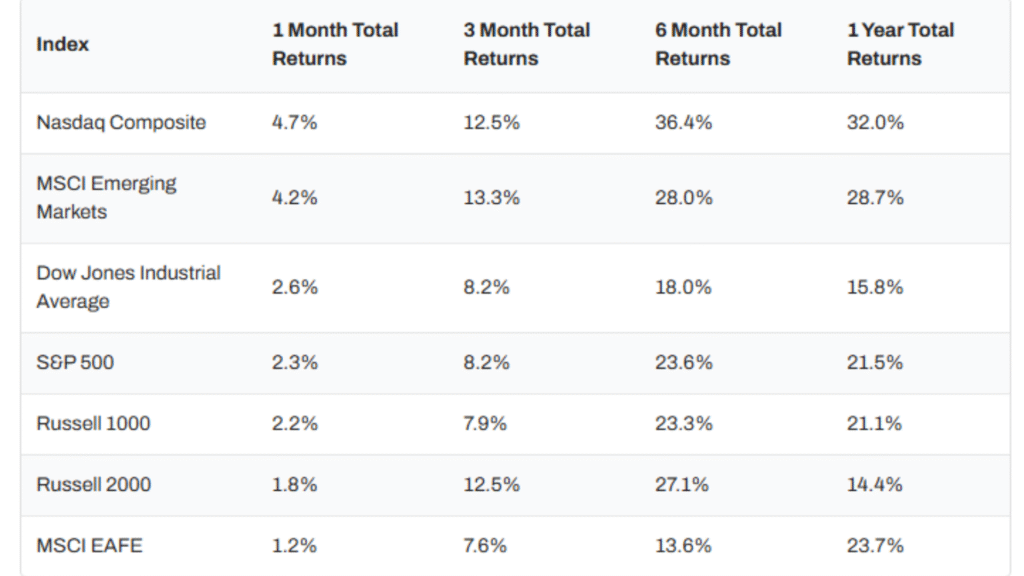

Markets notched a second straight up month in October. The S&P 500 added 2.3%, powered by the Nasdaq (+4.7%) and emerging markets (+4.2%). October’s broad advance came alongside the Fed’s second consecutive 25 bps cut, which kept risk appetite in gear. Under the hood, sector leadership was mixed: Tech was the standout again—up nearly 7%—while Communication Services, Real Estate, and Financials lagged. Materials was the biggest drag, down 4.4%.

On the mega-cap front, Nvidia (NVDA) has entered rare air. Its market cap now tops $5T—bigger than the GDP of any country except the U.S. and China. Over the last decade the stock is up ~28,900%, and it now makes up about 8.5% of the entire S&P 500—a striking level of single-name concentration. Put differently, NVDA has shifted from “bellwether of innovation” to a barometer for market sentiment, moving indices and portfolios all by itself.

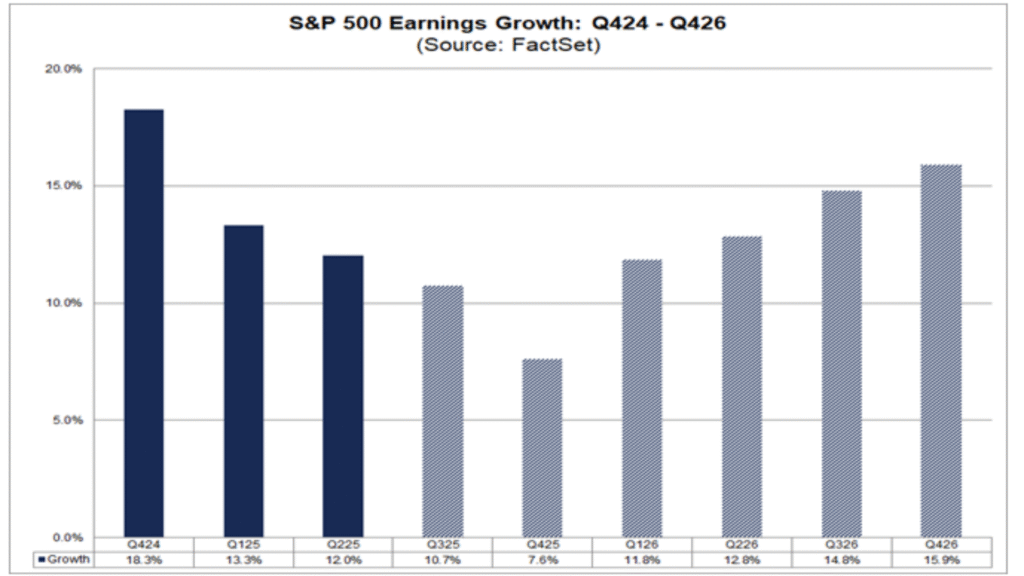

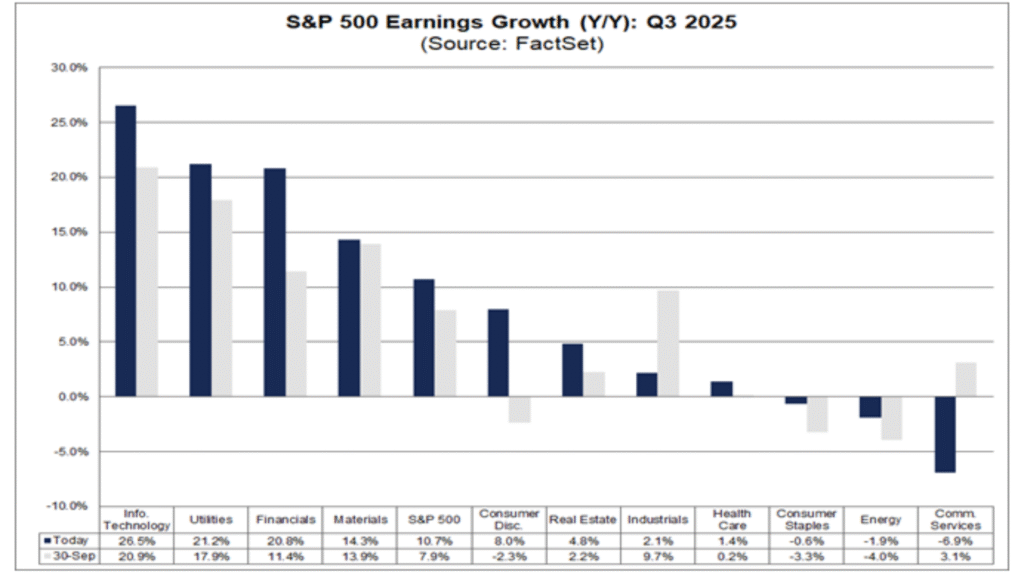

FactSet now pegs Q3 S&P 500 (blended) EPS growth at 10.7%, up from 9.1%. If that holds, it’s the fourth straight quarter of double-digit year-over-year earnings—solid momentum. Leadership is broadening too: four sectors—Info Tech, Utilities, Financials, and Materials—are all posting double-digit gains.

What’s notable is the steady grind higher as results came in. Back on June 30, Q3 growth was estimated at 7.3%. By September 30, that ticked up to 7.9%. Today we’re at 10.7%—a classic earnings season “beat-and-raise” pattern.

At the company level, the heavy lifters are familiar names. Four of the biggest positive contributors since September 30 are “Mag 7” members—Alphabet, Amazon, Microsoft, and Apple—while the largest drag is also from the same club: Meta. In short, breadth improved, but mega-cap tech is still steering the headline number.

Financials are doing the heavy lifting this season. Since September 30, the sector’s blended EPS growth has jumped from 11.4% to 20.8%—the biggest boost to S&P 500 earnings momentum. Tech is a close second: its blended growth rate climbed to 25.6% from 20.9% over the same stretch.

Looking ahead, the Street sees the earnings engine staying warm. Consensus calls for double-digit S&P 500 EPS growth in four of the next five quarters, with estimates at 7.6% for Q4’25, then 11.8%, 12.8%, 14.8%, and 15.9% through Q4’26. In short: breadth is improving, and the two biggest profit machines—Financials and Tech—are still setting the pace.

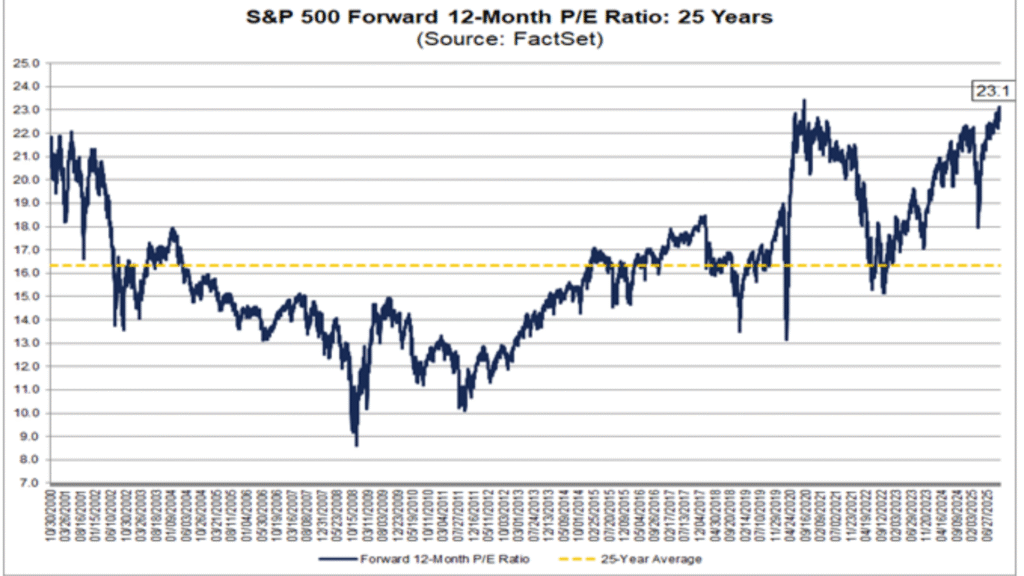

The S&P 500’s forward 12-month P/E ended October at 23.1—rich versus the 5-, 10-, 15-, 20-, and 25-year averages (19.9, 18.6, 17.0, 16.1, 16.3). Still, it’s shy of the ~24.4 peak from the last three decades. In short: elevated, not extreme.

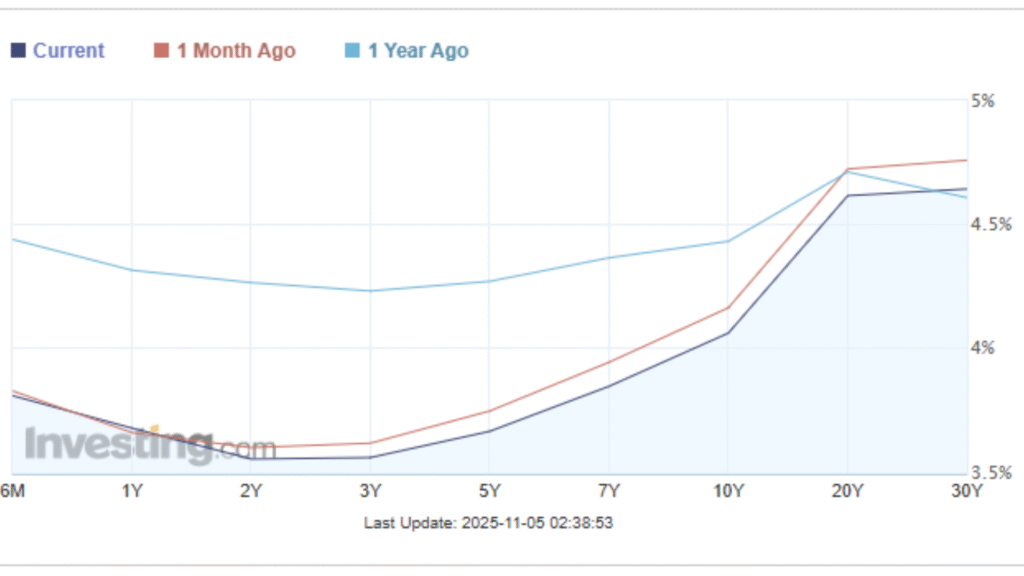

Fixed Income & Treasury Yields

Treasury yields eased across most of the curve in October, with the 1-year the lone riser. The biggest move was at the very front end: the 1-month fell 14 bps to 4.06%, and the 3-month slipped 13 bps to 3.89%.

Another Fed Rate Cuts

A government shutdown delayed key prints, muddying the macro picture. The headline development: another 25 bp Fed cut, taking the funds rate to 3.75%–4.00%. Inflation is mixed—headline CPI at 3.01% YoY while core edged down to 3.02%; CPI ran 0.3% MoM. Personal spending wasn’t reported due to the shutdown. Powell flagged that “job creation is pretty close to zero” and pushed back on the idea that a December cut is a done deal, even as market odds still lean that way.

Crypto and Commodities

Gold added 1.8% after a record September, with GLD around $368. Oil softened: Brent −4.4% to ~$65.52 and WTI −1.7% to ~$62.13. Crypto had a rough month despite a strong YTD: ETH −9.8%; BTC −5.3% to about $108,241 per coin.

Market Outlook

November’s setup is cautiously risk-on: earnings revisions are trending higher, breadth has improved (Financials joining Tech), and valuations—while elevated—aren’t at extremes. The key swing factors are the October CPI on Nov 13 and Nvidia’s Nov 19 earnings. A benign inflation print plus solid NVDA guidance should keep the “soft-landing + AI” narrative intact; a hot CPI or a cautious NVDA outlook would likely spark a quick rotation toward quality/value and pressure high-beta growth.