September Market Wrap — A Surprisingly Strong Month for Stocks

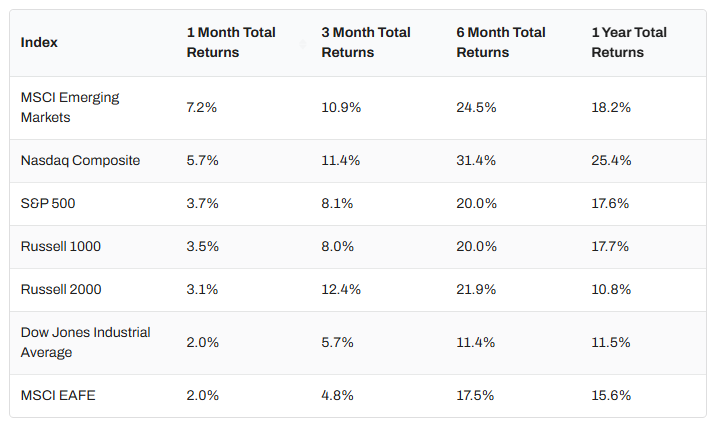

Markets rallied across the board in September, defying the month’s usual reputation as a rough stretch for equities. The S&P 500 climbed 3.7%, marking its best September in 15 years. All major indices posted gains, led by a standout 7.2% surge in emerging markets. The broad-based strength reflected renewed investor confidence as the Federal Reserve delivered its first rate cut of the year.

Sector performance was mixed. Technology roared back with a 7.5% gain after a sluggish August, while Consumer Staples, Materials, and Energy slipped into the red. Financials were essentially flat, eking out a 0.1% uptick for the month.

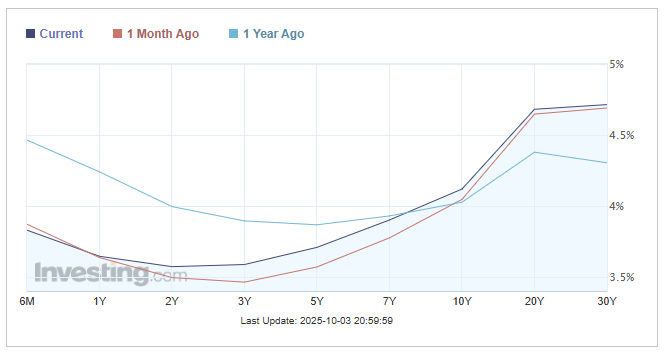

Fixed Income & Treasury Yields

In the bond market, Treasury yields generally moved lower, though the short end — the 2-, 3-, and 5-year notes — inched slightly higher. The 30-year yield saw one of the sharpest moves, down 19 basis points to 4.73%, reflecting expectations for slower growth and a more accommodative policy backdrop following the Fed’s pivot.

Fed Rate Cuts Take Effect

September brought the long-awaited first rate cut of the year, as the Fed trimmed its target range to 4.00%–4.25%. After months of speculation, the move landed with a soft thud—markets had already priced it in. The S&P 500 still managed to inch up about half a percent in the week that followed, a clear sign that investors saw the decision as validation rather than surprise.

In his post-meeting remarks, Chair Jerome Powell summed up the current dilemma: “Risks to inflation are tilted to the upside, and risks to employment are tilted to the downside—a challenging situation.” The Fed’s updated dot plot now points to two more cuts in 2025, signaling a gradual march toward policy normalization.

Economic Snapshot

- Jobs: 22,000 new jobs added in August, well below 75,000 estimates; fourth straight month of missed estimates

- Unemployment: Rose slightly to 4.3%

- Home Prices: The median existing-home price fell for the second straight month to $422,600, down 0.73%.

- Inflation: Core CPI steady around 3.1%

Crypto and Commodities

Cryptocurrencies

Digital assets had another uneven month. Bitcoin rose 5.1% to $114,309, while Ethereum cooled off, falling 3.6% after an impressive three-month rally that saw gains north of 70%.

Commodities

Gold continued its remarkable run, jumping 12% to fresh all-time highs. Oil prices were steadier—Brent crude rose 1.7% to $69 per barrel.

Market Outlook

Markets enter October with renewed optimism after the Fed’s first rate cut in over a year, though growth concerns linger. Job creation remains weak, and unemployment continues to edge higher, shifting attention from inflation to economic momentum. Investors are largely expecting another 25-basis-point cut later this month, reinforcing the Fed’s cautious path toward supporting growth without reigniting inflation.

Earnings season will drive market direction, with tech and consumer sectors likely benefiting most from easing rates. Still, tighter margins and softer demand in financials and industrials may limit overall upside. As volatility returns, diversification across equities, bonds, and real assets remains key—October looks set to reward balance over boldness.